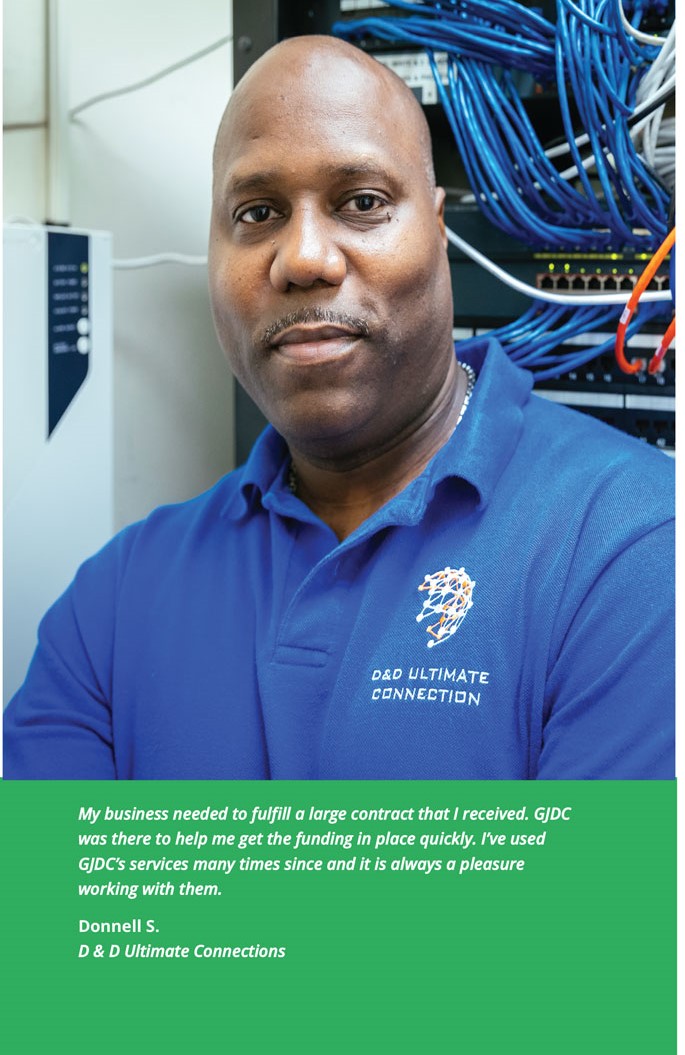

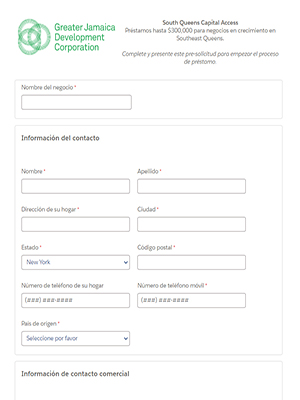

Southeast Queens Capital Access

Alternative Financing for Small and Mid-Sized Local Businesses

Capital Access is a revolving loan fund that invests in community businesses to create community jobs.

Who is eligible for financing?

- New and existing businesses located in Southeast Queens (in the 114xx and 116xx zip codes)

- Your business has sales of less than $10,000,000 and fewer than 500 employees

Loan Programs

- $10,000 – $300,000

- Interest Rates: Below market rates pegged to Wall Street prime

- Terms: Negotiable loan maturity period (usually five years)

- Asset-based for loans over $100,000 (Capital Access)

- Expedited turnaround for character- and credit scoring-based loans up to $100,000 (Capital Access Express)

- $10,000 – $25,000

- Interest Rates: Below market rates pegged to published prime rate

- Terms: Open Credit line (usually two years)

- Business expansion

- Façade or Merchandizing Improvement

- Purchase new equipment

- Buy or improve existing property

- Working capital

- Gap loan as part of loan basket with other financing

- Bridge loan while waiting for funding from another committed source

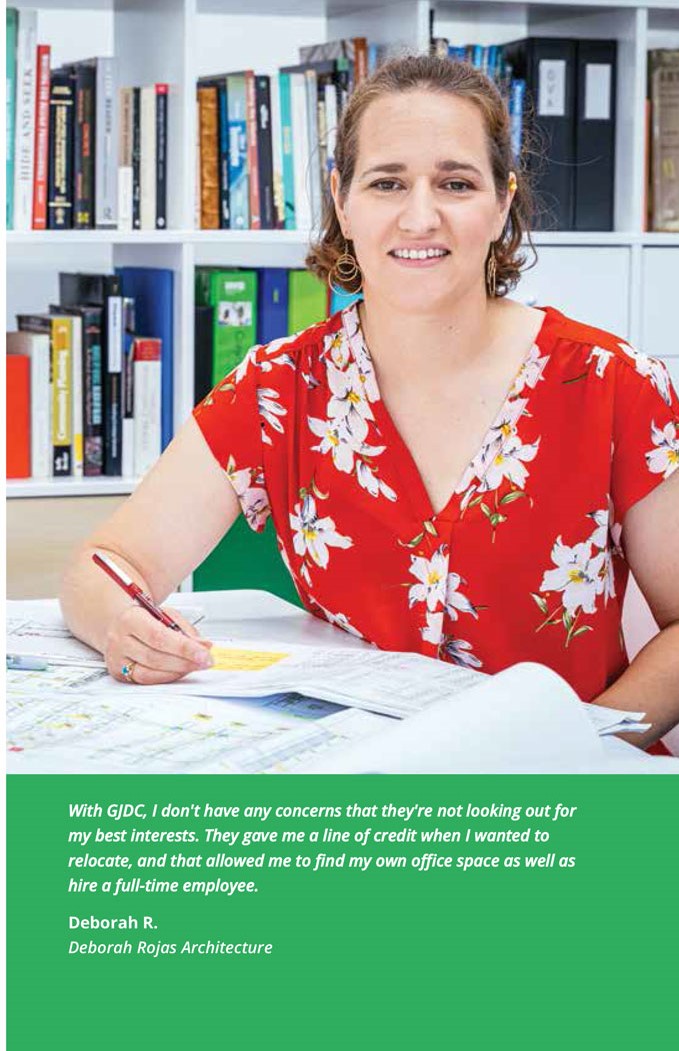

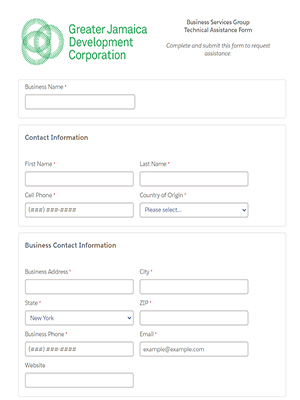

- One-to-one assistance to help prepare your loan application package is available to qualified applicants

- Flexible loan packages can be tailored to meet special needs

Contact

Adam Cohen

917-768-5134

acohen@gjdc.org

Jamaica Business Services Brochure